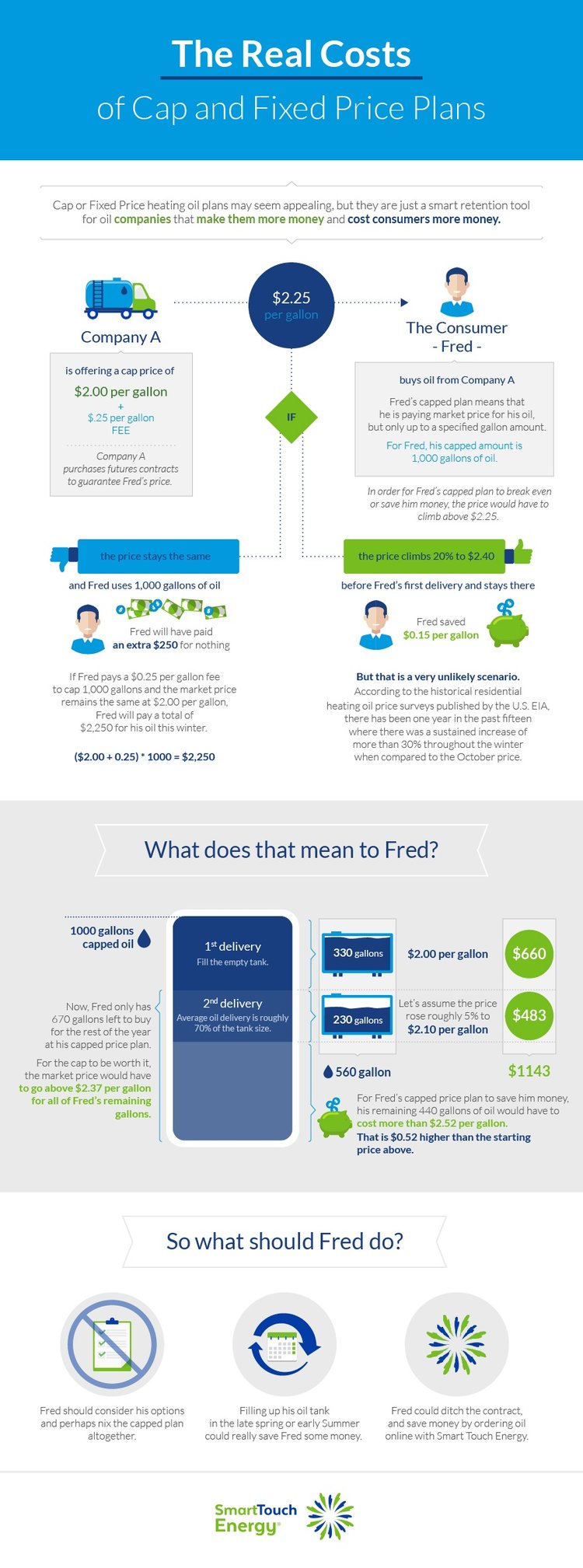

Heating oil customers throughout New England and the Mid Atlantic are bombarded with offers from heating oil suppliers to lock in their price for the winter either through a price “cap” or a fixed price plan. While on the surface these offers can be appealing, they are really a marketing and retention tool for oil companies that, over the last 10 years, have cost consumers significant amounts of money.

Pricing Plans Explained

Cap and fixed price plans are simply a tool, like insurance, to protect yourself and control costs in cases of extreme price spikes. As we all know, insurance companies never lose money and big oil companies are the same.

This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License.

If you have had enough, check live pricing today at Smart Touch Energy, and schedule delivery online. No Contracts. No Commitment. Never!

Example of Pricing Plans Work

To understand why, consumers need to understand how these plans work. Here is an example.

As a consumer you commit to buy your oil from Company A who is offering a cap price of, let’s say, $2.00 with a per gallon fee of $0.25 per gallon.

Then, the oil company purchases futures contracts to be able to guarantee your price.

If today’s market price is $2.00 per gallon, you’re paying $2.25 per gallon when you include the $0.25 per gallon fee.

For a capped plan to break even or save you money, the price would have to climb above $2.25 per gallon.

If the price stays the same, and you use 1,000 gallons of oil, you’ve paid $250 for nothing.

If the price climbs 20% to $2.40 before your first delivery and stays there, then you’ve saved $0.15 per gallon. But that is a very unlikely scenario.

Here’s the reason why. If you pay your $0.25 to cap 1,000 gallons and the market price remains the same at $2.00 per gal, you’ll pay a total of $2,250 for your oil this winter.

($2.00 + 0.25) * 1000 = $2,250

If you have a 330 gallon tank, the average delivery is about 70% of the tank’s capacity (roughly 230 gallons), then you’ll need 4-5 deliveries per year depending on what’s currently in your tank. We’ll assume that every delivery is for 230 gallons.

If today your tank was empty, and it took the full 330 gallons to fill gallon tank at $2.00 per gallon, it would cost approximately $660. Now you have only 670 gallons left to buy for the rest of the year.

For the cap to be worth it, the market price (determined by the oil company) would have to go above $2.37 per gallon for all of your remaining gallons.

Let’s assume the price rose roughly 5% to $2.10 per gallon for the second delivery, which will likely be about 230 gallons, then the cost would be $483.

Now, you’ve purchased 560 of your 1,000 gallons and have spent a total of $1,143, so your remaining 440 gallons would have to cost more than $2.52 per gallon for the capped price to save you money. Note that is $0.52 higher than the starting price above.

According to the historical residential heating oil price surveys published by the U.S. Energy Information Administration (EIA), there has been one year in the past fifteen where there was a sustained increase of more than 30% throughout the winter when compared to the October price. There were a couple of times where the average price spiked for 2-3 weeks, but for the majority of people with oil heat that is only a single delivery. Outside of the one extreme and a few very short-lived instances, a cap plan would not have saved consumer’s money given a cost to participate of $0.25 per gallon. In fact, in the majority of years the average price paid in February is LESS than the price paid in October.

Now, hopefully you are seeing the point. The oil company wants you to pay the premium to price protect ALL OF YOUR GALLONS when, in reality, there are very few instances where capping your price makes sense. Additionally, because you have committed to buy from them, should the price of oil fall, you've wasted the fee and could be restricted from buying from another supplier.

An important thing to note when shopping around for heating oil is that the “market price” your Big Oil company charges is determined by the oil company, not the actual market. So even when their cost of oil goes down, they may hold their “market price” artificially high at the cap level to gain additional profit.

Now that is not to say all cap or fixed price programs are bad, but the data says they don't make sense when you look over the past 15 years.

So, What Should I Do?

The best way to avoid the high prices and poor service of big oil is to buy from Smart Touch Energy. Smart Touch Energy has wonderful group of locally owned oil companies who are fighting back against big oil. They deliver a premium buying experience at an affordable price. By putting consumers back in control of their energy bills, customers of Smart Touch Energy are able to save an average of $300 per year when compared to the big oil companies. And unlike big oil companies, Smart Touch Energy’s automatic customers pay less than one-time customers.

While buying from Smart Touch Energy is the smart choice, another option is to fill up in the late spring or early summer. Oil companies operate on smaller margins during those times and consumers can capitalize on that. During the winter months, compare your options to keep warm.